Brexit: Summary Notes On Potential Impact

Pundits seem divided on the impact of Brexit to the US. One viewpoint looks at Britain more in isolation and suggests that the main impact will be to US export manufacturers as the pound depreciates relative to the US dollar. A second camp cautions of the possible longer term consequences to the fabric of the UK, the European Union and the fragile global economy. It looks at Brexit as symptomatic of the trend underway for several years of a backlash towards globalization worldwide and the rise in intensity of populism here and abroad.

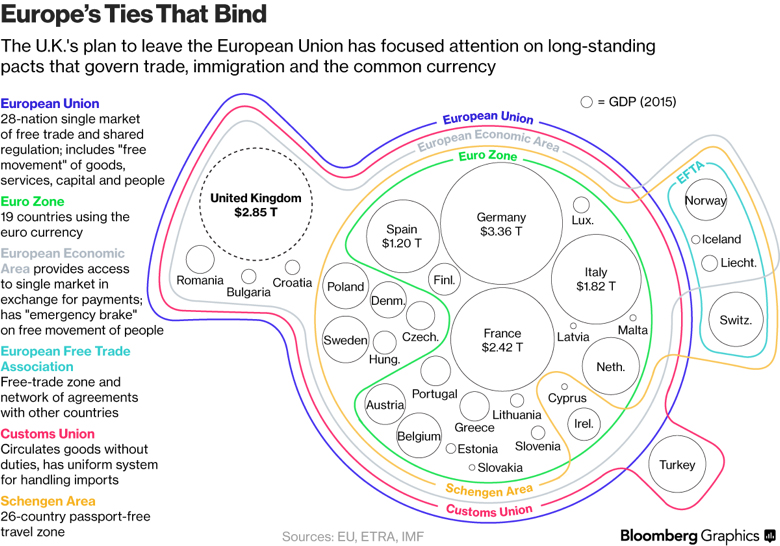

Regarding the UK and EU, the chart below illustrates the intricacies of the long-standing integration pacts governing the UK’s relationship with the EU. Its divorce from the EU will be messy and drawn out over several years with no distinct winners. In the broadest context, regardless of which camp one falls into, Brexit is another shock to the global economy, making it more vulnerable to the next bad thing and placing greater weight on the US to support growth.

Global growth forecasts have again been trimmed from already anemic levels, possibly bringing at least the UK and EU back into recession. In the US, the Fed contends with indicators of modest economic strength and record-level asset valuations against this weak backdrop. Tight supplies and investors desperate for income in a world of managed interest rate declines are propping up both bond and equity markets despite six quarters in a row of falling fundamental profitability and credit ratings. Expectations of a stronger 2nd half for equities based on a weaker dollar will need re-evaluation as Q2 earnings begin to report.

Despite the market rally, consumer confidence may be peaking as JP Morgan estimates the US consumer has already spent 58% of the gasoline price windfall, most of which was actually spent on premium fuel! In the last year, the personal savings rate has risen to 13.4% with consumer spending growing at a rate of only 3.7%. High yield delinquencies have risen to 6.6% from 3.9% eight months ago. Retail investors are continuing to park $52 Trillion on the sidelines, which may be the only reason we remain out of bubble territory.

Risk aversion was high before Brexit, and this vote is likely to further heighten investors’ fears and market volatility. The current market complacency, as investors are forced into equities for the dividend yield, only concentrates the risks.

As before, times of uncertainty eventually open the door for opportunity. There are many innovations in technology and healthcare that could present opportunities at lower market prices.

Linda von Wernitz

Linda A. Mundy